IRS Controversially Claims Hiring 87,000 New Agents Won't Mean Higher Audit Rate for the Middle Class

So why do Democrats keep equivocating on the point that households making under $400,000 may be targeted for more audits by an expanded IRS?

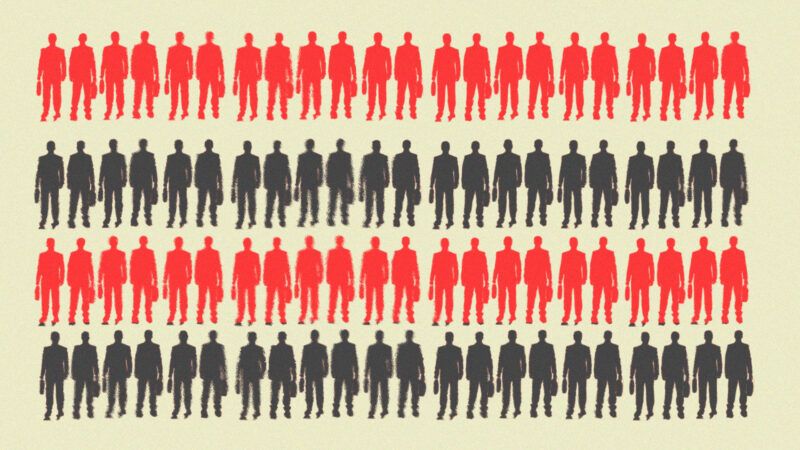

Since the Inflation Reduction Act passed the Senate and is now headed to the House for a Friday vote, Republicans have loudly critiqued the IRS-supersizing provisions while Democrats have tried to assure voters that hiring an additional 87,000 tax-collecting agents, as the legislation calls for, will not lead to higher audit rates for middle- and upper-middle-class taxpayers:

IRS Commissioner: "These resources are absolutely not about increasing audit scrutiny on small businesses or middle-income Americans… designed around Treasury's directive that audit rates will not rise relative to recent years for households making under $400,000."

Liar: https://t.co/D2sgyo0DZo

— Jesse Lee (@JesseLee46) August 9, 2022

The House version of the legislation had originally contained a line saying "nothing in this subsection is intended to increase taxes on any taxpayer with a taxable income below $400,000″—which was hardly a solid guarantee in the first place, and offered no assurance that audits for this income band would not rise. All this was seemingly an attempt to reflect President Joe Biden's frequent campaign pledge, reiterated in his State of the Union address, that taxes wouldn't effectively be raised for the middle class, defined generously.

This isn't true. It's made up to scare you.

The Inflation Reduction Act includes money for the IRS to curb an epidemic of tax cheating amongst the millionaires and billionaires. Under bill, audit rates won't increase for anyone making under $400K. https://t.co/evKDiaZxVU

— Chris Murphy (@ChrisMurphyCT) August 6, 2022

But if Sen. Chris Murphy (D–Conn.) and other Democrats meant what they said, they shouldn't have killed a similar assurance when it was offered in the Senate version as an amendment, "nodding to the notion that taxpayers making under $400,000 wouldn't be the subject of increased audits," says Andrew Lautz of the National Taxpayers Union. Meanwhile, "the oversight and reporting provisions [which were also removed] ensured Congress could keep a regular and watchful eye over the agency's plans," he adds.

"What comfort do taxpayers have in the absence of those provisions? Statements from members of Congress and the administration. That will be cold comfort to some," says Lautz.

Meanwhile, IRS Commissioner Charles Rettig hedges by saying that "audit rates will not rise relative to recent years." This depends on what he means by "recent years." It also depends on what he means by "audit rate." As in, if the total number of audits drastically increases, then the audit rate of certain income bands might stay the same or even decrease—some convenient trickery that may allow him to be correct on a technicality.

"Millionaires in 2018 were about 80% less likely to be audited than they were in 2011," reported ProPublica in 2019. Audit rates circa 2010–2011 were such that about one in six rich households—defined as those earning over $5 million—was audited, versus about one in 50 circa 2019. So Rettig may be counting 2010 as a recent year, or he may be counting 2019 as a recent year, but which years he's referring to matters when assessing how audit rates might change.

In 2018, "the top 1% of taxpayers by income were audited at a rate of 1.56%. EITC [earned income tax credit] recipients, who typically have annual income under $20,000, were audited at 1.41%," found ProPublica. These converging audit rates, where poor and rich are somewhat equally targeted by the IRS, is due in part to the fact that audits hitting EITC recipients are quite easy to do, frequently called "correspondence audits." The IRS finds lots of noncompliance this way, and is generally able to conduct these audits by mail, assigning low-level agents to these cases. There's no real reason to believe some of these newly hired 87,000 agents—who will necessarily be inexperienced—won't be assigned to conduct correspondence audits or those which crack down on the nonrich. But again, if the overall number of audits drastically increases, then Democrats may be hoping they'll be able to tout the audit rate as having stayed the same for poor people.

There's a separate case to be made that the "working rich"—high-earning doctors and lawyers, with dual-income households generating in the ballpark of $400,000 per year—similarly do not deserve to have a legion of IRS agents breathing down their necks. Given that the U.S. has physician and pilot shortages, perhaps it is a fool's errand for the government to disincentivize smart, hardworking people, who are unlikely to ever require government welfare, from pursuing high-paying professions.

All that aside, the specific claim being contested by today's partisans is whether adding a massive stadium's worth of agents to the IRS is likely to increase audits and audit rates for households making under $400,000 a year. It's hard to imagine it won't, especially given that it is frequently much easier for auditors to go after poorer people than those armed with teams of lawyers. It's harder still to imagine why a provision that attempted to clarify this intention was removed if lawmakers are serious about their promise.

Show Comments (117)